Iran Capital Market

History and the Development

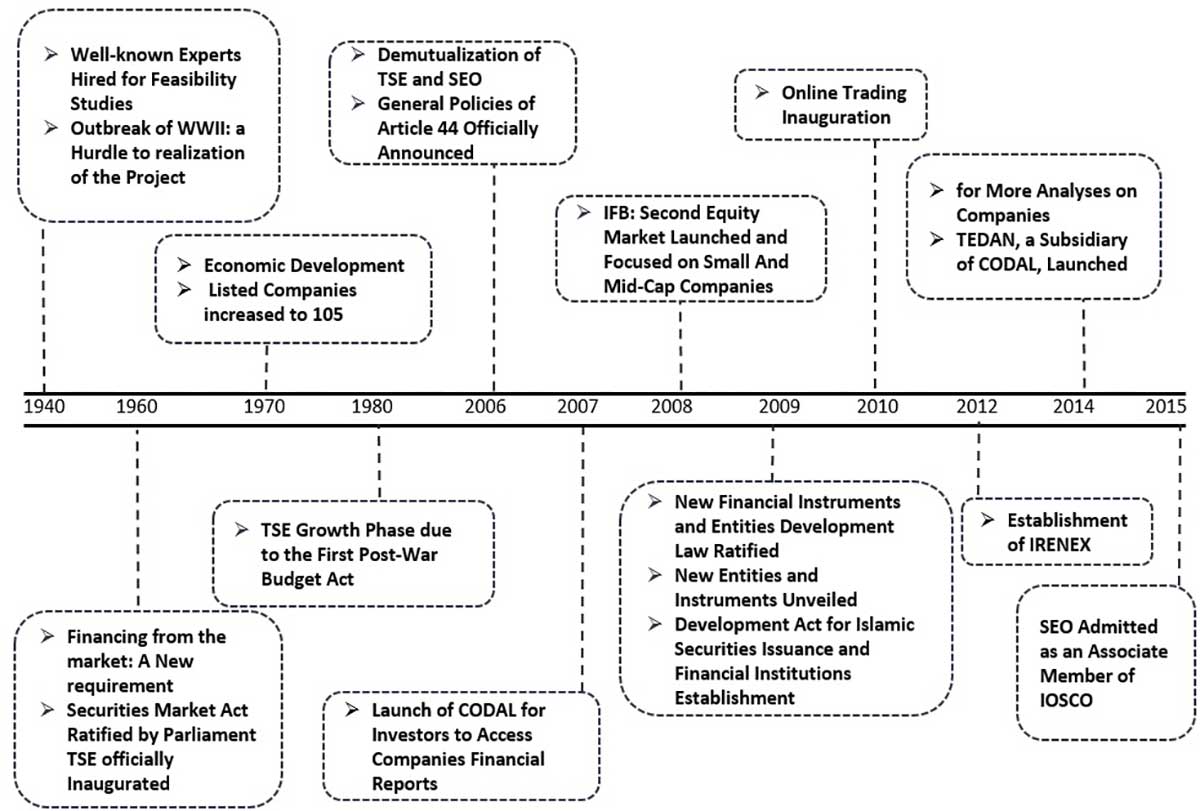

The introduction of stock exchange concept in Iran dates back to 1936 when Melli bank of Iran with the assist of Belgian experts published a report on a plan for an operational stock exchange in Iran.

Later on a group of Well-known Experts performed a Feasibility Studies, but the Outbreak of WWII stopped the realization of the Project. In 1960 the “financing requirements from the market” highlighted the importance of the Capital market. Finally in 1967 Securities Market Act Ratified by Parliament and The Tehran Stock Exchange, abbreviated as “TSE”, was inaugurated.

Economic Development of 1970 in Iran leads to Increase in Listed Companies up to 105 companies.

In 2006 the parliament passed the “Capital Market Law”, which facilitated the introduction of a new securities underwriting system in the market. The intention was to establish the Securities and Exchange Organization (SEO) as a separate body to oversee and regulate the TSE and the other exchanges forming part of Iran Capital Market.

TSE has been a full member of the World Federation of exchange since 1995 and it is also a founding member of Federation of Euro-Asian Stock Exchanges (FEAS). Since 2010 TSE has been a member of the International Options Market Association.

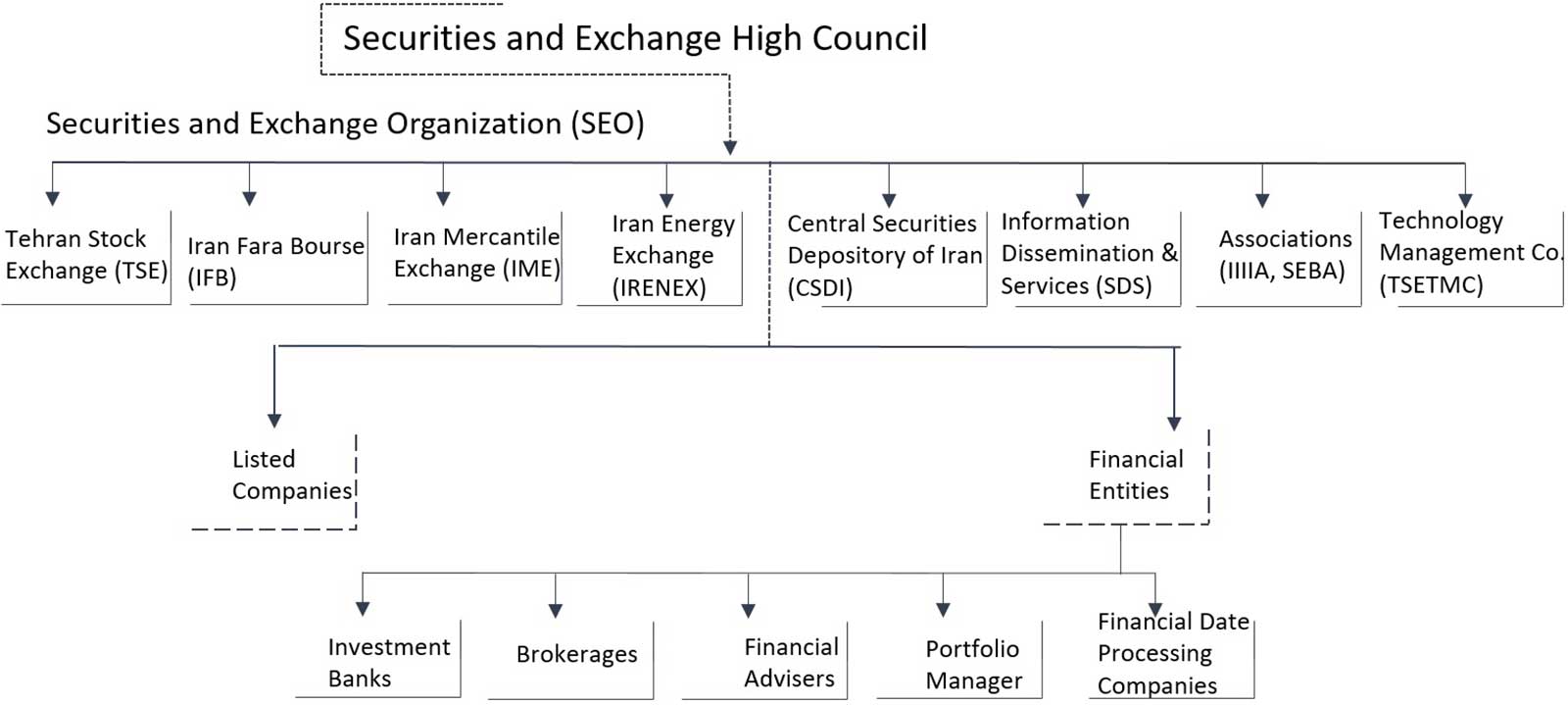

The Securities & Exchange Council and the Market Structure

The Securities & Exchange Council is the top authority and is responsible for supervision of the Iran Capital market, all related policies, market strategies and oversee and approve planned financial instruments.

The Chairman of the Council is the Minister of Economic Affairs and Finance and other members of the board are:

- Minister of Commerce

- Iran’s Governor of the Central Bank

- Heads of the Iranian Chamber of Commerce, Industries and Mines and the Chamber of Cooperatives

- Chairman of the Securities and Exchange Organization (SEO)

- Attorney General and his deputy

- One representative on behalf of the Associations

- three financial experts from the private sector on the proposal of the Economics Minister and approval of the Council of Ministers

- One expert solely from the private sector as recommended by the responsible minister and approved by the Council of Ministers of each commodity exchange

The Securities and Exchange Organization (SEO) is accountable for administrative and supervisory duties. There is a Board of Directors that is governing the Organization. . The Securities and Exchange Council elects the SEO’s Board of Directors.

Market Overview

Currently, there are around 393 actively traded companies in the market that are making around $100bn Total Market Cap. (Combined TSE and Iran Fara Bourse )

| Sectors | Number of listed Companies | AVG P/E | Est. Market Cap m$ |

| Petrochemical | 75 | 6.0× | 23,261 |

| Metals | 45 | 13.1× | 14,056 |

| Banks | 25 | 149.9× (Highest) | 10,289 |

| Refineries | 27 | 6.1× | 7,010 |

| Telecommunication | 12 | 4.4× | 6,859 |

| Metal Ores | 15 | 7.7× | 5,402 |

| Conglomerates | 5 | 4.7× | 5,060 |

| Automobile & Auto Part | 38 | 21.1× | 4,426 |

| Pharma | 40 | 6.6× | 3,743 |

| Utility | 24 | 4.8 | 3,309 |

Top 5 sectors based on the Est. Market Cap are Petrochemicals, Metals, Banks, Refineries, and Telecommunication.

The average P/E multiple is 6.5× , which suggest high return in comparison of S&P 500 median P/E ratio of around 14×.

The average free float is around 20% and the average daily volume ytd. 2017 is almost $70m.

Iran Capital Market has its advantages in comparison with other regional markets. The diversity of the industries makes the market favorable for many individual investors. There are 37 industries directly involving the capital market. Investors can trade stocks of companies in various industries such as automotive, Petrochemical, Pharma, Telecommunication, agriculture, banking, and insurance. This characteristic makes the Iran Capital Market unique in the Middle East.

The other advantage is the act of privatization of the state-owned firms under the article 44 of the Iranian constitution. Under the circumstances, private investors are purchasing the newly privatized firms shares.